As property investors, we all want to build a substantial property portfolio that can hopefully set us up for life.

The problem many people run into is just because you’ve managed to build up a number of assets over time, doesn’t actually mean they are going to help you achieve your goals. In fact, choosing the wrong assets can quickly put you back decades not to mention the lost opportunity comes that comes along with that.

That’s why when we talk about buying properties it’s important to understand the difference between an investment and speculation.

For me, the most important element of a property is that it will likely continue to appreciate in value over time. If your property isn’t going to increase in value then you might have an asset on your hands, but the reality is that you’ve also got a large pile of debt that is accruing interest along the way.

I like to invest in properties that are such that they have a very high chance of increasing in value over time, no matter what the current economic conditions are or what the latest crisis in the world might be.

One of the easiest ways to accomplish this is by looking to invest in suburbs that have a long term history of capital growth. While it might be nice to pick an upcoming suburb or town that is set for a huge uplift in growth (think mining town etc), I would much rather look for a suburb that is growing for the right fundamental reason right now.

That’s likely to be a suburb that has clear demand, in that it is highly desirable, with great amenity and close to things like rivers and beaches.

On the flip side, that suburb should also contain genuine scarcity. If we combine those two simple factors, they alone are enough to suggest that this particular suburb or area will likely be able to keep on growing at the same rate that it has been in recent times.

This is what as the top buyers agency in Melbourne we would consider to be a genuine investment.

If you look to invest in something like a mining town or a new ‘up and coming,’ outer suburb without a proven track record – you’re just speculating.

You’re making the assumption that the mine actually gets the go-ahead, or that people will actually want to live and commute from a new outer suburb. The reality is that these events may or may not happen and to this point in time, there is no track record of demand.

The most obvious example of a suburb that you shuold expect to see continue to grow over a long period of time is a place like Bondi Beach.

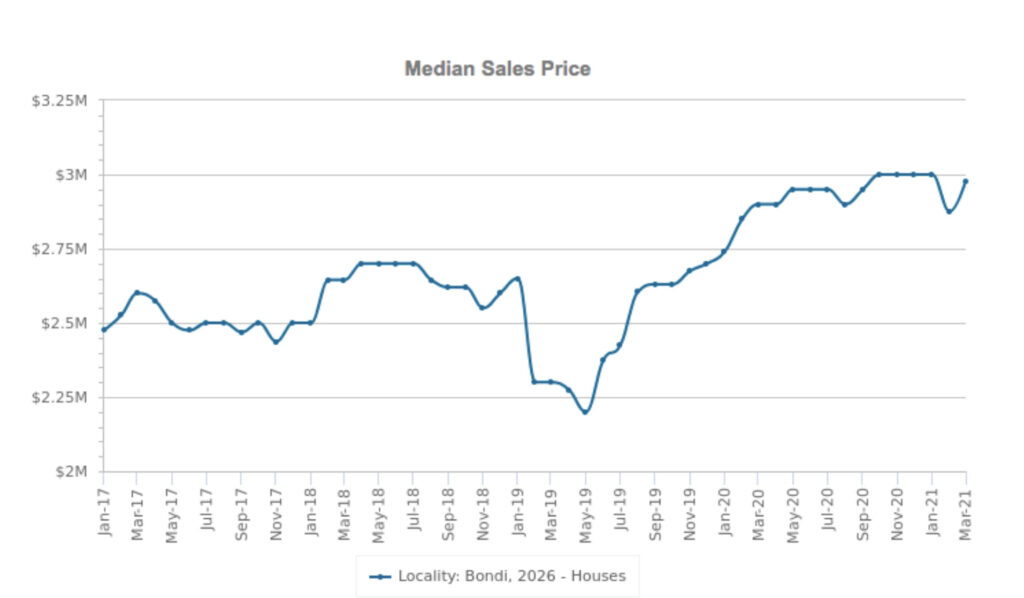

Source: CoreLogic

According to CoreLogic data, house prices in Bondi have increased in value at a rate of 9.09% per year, while units have increased by an average of 6.79%. Bondi is a location where scarcity is high and only getting higher, while demand is always strong.

People want to live in Bondi for the great lifestyle that it offers as well as its location and access to everything that living in Sydney provides.

Looking back over the past five years and we’ve seen an end to the housing boom, APRA clamping down on lending, a Royal Commission into the banking sector, COVID, mass lockdowns and yet we still see house prices growing steadily in Bondi. I strongly suspect that is not going to be something that changes in the years ahead. That’s what I would call an investment.

If you’re looking to start building a property portfolio, consider the asset that you’re buying and whether or not you are buying an investment or just speculating in the hope that future growth might come.