With house prices now growing at the fastest rate we’ve seen in 32 years, the media have been quick to suggest that we are now facing another housing affordability crisis.

Just last month, property prices in Sydney increased by an impressive 3.7% while detached homes jumped by 4.1% according to the latest data from CoreLogic. Sydney house prices are now back above their previous record high levels set in 2017 so it appears we are in the midst of a housing boom.

However, to suggest there is a housing affordability crisis would be a mistake. In fact, houses are now more affordable than they were back at their peak around five years ago.

Interest Rates

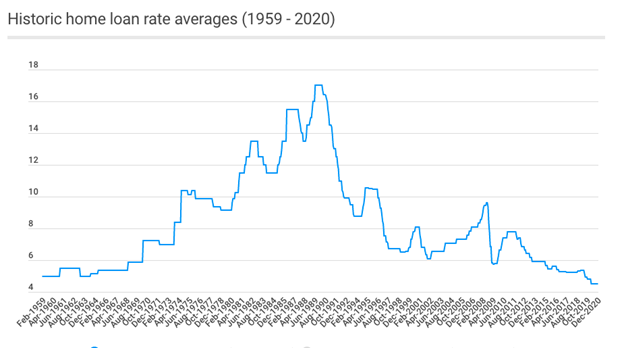

The most obvious reason as to why houses are actually more affordable now than during the most recent peak in house prices is simply because the cost of borrowing is significantly lower.

Thanks to COVID, the RBA moved quickly to slash interest rates and currently, the official cash rate remains at a record low level of 0.1%.

What that means is that you can now borrow $1 million and you only need to pay back around $400 of interest each week.

Compare that to 2017, when mortgages were around 5% and that would see a borrower paying back more than $1,000 per week to borrow that same $1 million.

What that means is that a property that was priced at $1.5 million prior to COVID, could increase in value to $2 million and the level of repayments would be very similar. That suggests the relatively small increase we’ve seen in house prices so far still has room to move. It also means houses are still very affordable compared to any time in the last 70 years.

The RBA has also noted that they intend to leave interest rates at current record low levels for the next 2-3 years, meaning borrowers on variable home loans will have some time before things change. Even when rates do rise, it’s unlikely that they are going to jump dramatically, hence the small rise we’ve already seen in the Australian 10-year bond.

Serviceability

One of the other key elements that impacts borrowers is the ability to get finance. As a Brisbane-based buyers agency we know, during that last housing boom, APRA made things difficult for both owner-occupiers and investors by keeping their serviceability buffer high and putting a lot of pressure on lenders who offered interest-only loans.

While the serviceability buffer is now lower than what it was, lenders are still being relatively cautious.

However, with the serviceability buffer also being around 5% compared to 7%+ up until 2019, clearly getting finance is also easier than what it was before.

Government Support

It’s also very clear that some of the Government incentives that we’ve seen over the past 12 months have certainly added to the level of affordability. This is very clear in the first home buyer market, which has seen significant stamp duty exemptions and building bonuses.

This is possibly one area of the market that will likely see a slow down as much of the demand has clearly been bought forward. With stamp duty exemptions tightening up, that will cause an issue with affordability for certain segments of the market. However, theoretically, this segment of the market should have already done their buying.

Australia still lagging

The other important point to note is that while Australia has traditionally had high property prices, this latest surge in prices is still lagging other countries.

So far in 2021, house prices have increased by 6.1% across the country, however, when we compare that to New Zealand, which is up by 16% or to the US and UK, which have also seen double-digit growth, then we can see that Australia is just following suit.

New Zealand is the one country that is starting to see house prices grow very quickly and the RBNZ is taking steps to slow that down. So far, the RBA is holding course.

For the time being, there is no doubt that Australia is in the midst of another boom in house prices. Low interest rates, low supply and strong interest from buyers is also likely to see that continue for the foreseeable future. However, until we see an increase in interest rates, it is still cheaper to buy a house now than it was in 2017 and it’s actually more affordable to borrow than we’ve seen in 70