There’s no doubt cash flow has a role to play in property, but it’s not going to be the thing that will ultimately grow your portfolio.

That’s always going to come from capital growth.

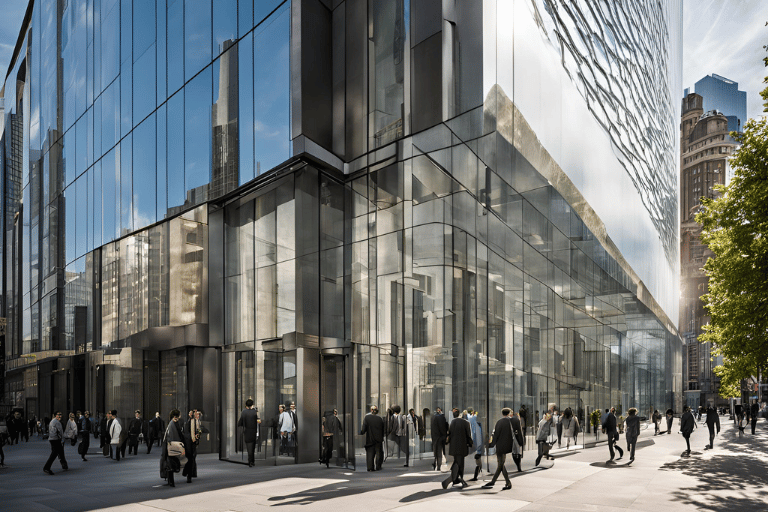

If you’re chasing growth, I recommend investing in the best location you can.

For too often people will choose secondary locations and poor regional areas in search of higher yields.

Sure yields have a role to play, but over time, you need growth. The safest growth will normally come from blue-chip locations.

So if you have a decent budget to spend, look to buy the best asset you can. Don’t split it up into multiple properties.

Better yet, you can look to manufacture equity through something like a renovation.

If you buy well, you can effectively get yourself into a premium location at a discount. That gives you a great starting point to hold onto the property for the long term, all while realising a quick equity uplift.

What are you looking to do with your next property purchase?

- Focusing on buying the best possible asset.

- Looking for yield to help with the mortgage.

- Manufacturing equity in a quality location.

Engaging a trusted buyers advocate through Henderson’s buyers advocacy service is your best chance at navigating the competitive real estate market.