Investing in property is a big decision, and one that requires careful consideration to ensure that you choose the right location. However, despite the importance of location, many property buyers make the same common mistake of buying in the wrong area. In this article, we will discuss the significance of considering location when purchasing property, the common signs of a bad location, and the hidden costs associated with a bad location. We will also provide tips on how to identify the right location for your property purchase.

“Understanding the Importance of Location in Property Purchasing”

When investing in a property, location is one of the most critical factors to consider. It can affect every aspect of your investment, from property value to rental income potential. The location of a property will determine its convenience, accessibility, and surrounding neighborhood and amenities, all of which can greatly impact the final purchase decision. A desirable location will increase the property’s resale potential, rental income potential, and also protect against unexpected events such as natural disasters.

“How Location Affects Property Value”

The location of a property plays a significant role in determining its value. Properties located in high-demand areas or neighborhoods with easy access to basic amenities such as schools, hospitals, and retail centers tend to have higher values than those in remote or less popular locations. Additionally, a property’s location may attract specific types of buyers, such as families, retirees or young professionals, making the area a strong draw for those groups.

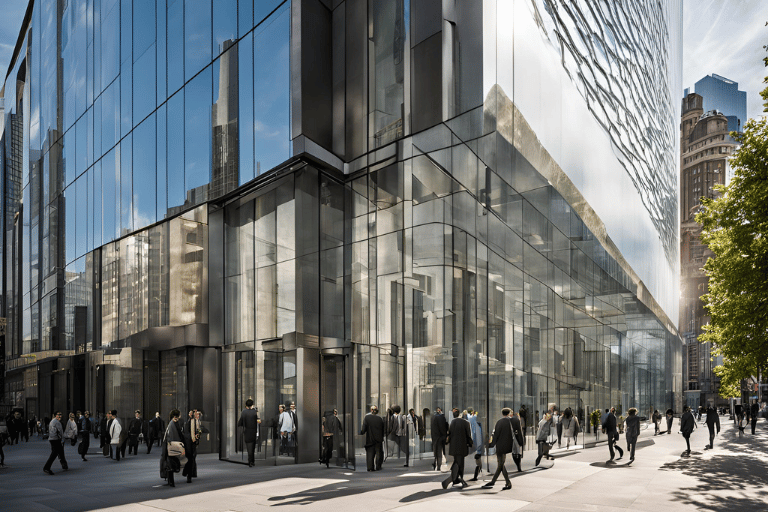

For example, a property located in a bustling city center with excellent public transportation links and close proximity to popular restaurants, bars, and shopping centers will likely have a higher value than a property located in a remote rural area with limited amenities. The former’s location is convenient and attractive to young professionals and couples looking for a vibrant and exciting lifestyle, while the latter’s location may appeal more to those seeking a peaceful and quiet lifestyle away from the hustle and bustle of city life.

“The Role of Location in Lifestyle and Convenience”

One of the most significant benefits of property location is that it can be tailored to suit your specific lifestyle needs. A property in an accessible location with good transportation links is perfect for those who commute regularly, while one in a quiet neighborhood with good schools is ideal for families with young children. Meanwhile, those looking for a peaceful, secluded property may prefer a countryside location.

For instance, a property located near a beach or lake may be perfect for those who love water sports and outdoor activities, while a property located in a bustling city center may be ideal for those who enjoy a vibrant nightlife and access to cultural events and attractions. A property’s location can also impact the daily commute, with a shorter commute leading to more free time for leisure activities or work.

“Location’s Impact on Future Resale Potential”

Choosing a property in a prime location guarantees higher resale potential in the future. This is because the value of a property will appreciate as the surrounding amenities and neighborhood develop and become more popular. It means your property can fetch a higher resale price that can even help you gain equity or profits over your initial investment. However, the opposite is also true; a bad location can lead to a drop in value and make it challenging to find buyers interested in buying the property.

For example, a property located in an up-and-coming neighborhood with new developments and trendy restaurants and shops will likely experience an increase in value over time. On the other hand, a property located in an area with high crime rates or limited access to amenities may struggle to attract buyers and experience a decrease in value over time.

Overall, the location of a property is a crucial factor to consider when investing in real estate. A desirable location can increase the property’s value, rental income potential, and resale potential, while a bad location can have the opposite effect. Understanding the importance of location in property purchasing can help you make informed decisions and achieve your investment goals.

“Common Signs of a Bad Location”

“High Crime Rates”

High crime rates are a common tell-tale sign of a bad location. It not only puts the property’s safety at risk but also dampens the neighborhood’s desirability. It is recommended to check crime rates in your area of interest before making any investment decision.

Furthermore, high crime rates can also affect the quality of life for residents in the area. It can lead to a lack of community engagement and a sense of isolation, making it more difficult to build relationships with neighbors.

It’s important to note that crime rates can fluctuate over time, so it’s a good idea to keep an eye on the trend in the area before making any decisions.

“Poor School Districts”

A property located in an area with low-performing schools or a lack of good schools can significantly impact its long term resale potential. Even if you aren’t planning on having children, purchasing a property in a good school district is still advisable since it’s a key feature that potential buyers will look for in the future.

Moreover, living in an area with good schools can benefit the community as a whole. It can lead to higher property values and a sense of pride in the neighborhood.

It’s also important to consider the proximity of the schools to the property. A long commute to school can be a burden for families and decrease the value of the property.

“Lack of Amenities and Transportation”

Properties situated in areas with limited access to quality amenities such as grocery stores, hospitals, and recreational centers are less desirable. Additionally, poor transportation links to and from the property can present a problem. Properties on busy roads or those with noise pollution problems can also diminish a property’s value and appeal.

Access to quality amenities can greatly improve the quality of life for residents in the area. It can also make the property more attractive to potential buyers or renters.

Furthermore, good transportation links can make it easier for residents to commute to work or school, reducing the stress and time spent on travel.

“Environmental Concerns and Natural Disasters”

There are also various environmental factors to consider when purchasing a property. These include the risk of natural disasters such as floods, hurricanes, or tornadoes. Properties situated in areas that require additional home insurance coverage due to environmental risks can become more expensive to rent or sell.

Environmental concerns can also affect the quality of life for residents in the area. For example, air pollution can lead to health problems and decreased property values.

It’s important to research the environmental risks in the area before making any investment decisions. This can include checking for flood zones, looking at the air quality index, and researching the history of natural disasters in the area.

In conclusion, there are many factors to consider when evaluating the location of a property. By doing thorough research and considering the long-term implications, you can make a wise investment decision that will benefit you in the years to come.

“The Hidden Costs of Buying in the Wrong Location”

When it comes to investing in real estate, location is everything. While it may be tempting to purchase a property in an up-and-coming area, it’s important to consider the potential hidden costs that come with buying in the wrong location. Let’s take a closer look at some of these costs:

“Increased Insurance Premiums”

Investing in the wrong location can lead to increased insurance premiums. Insurers often charge higher premiums in areas with high crime rates or environmental risks such as floods. This means that as a property owner, you may find yourself paying more for insurance than you had anticipated. These increased costs can result in more costly insurance policies and reduce overall revenue and profits.

“Lower Rental Income Potential”

Another potential cost of buying in the wrong location is lower rental income potential. A property located in an undesirable location may attract fewer potential tenants, leading to lower rental income potential. Finding tenants willing to pay high rent or meeting mortgage payments becomes challenging. This can result in a decrease in cash flow and a longer time to recoup your investment.

“Difficulty in Selling the Property”

Properties located in an unappealing location take longer to sell, resulting in additional costs and expenses. A property sitting on the market for a long time can have a negative impact on its value and will take longer to recoup your investment. In addition, the longer a property sits on the market, the more likely it is that you will have to lower the asking price, further reducing your profits.

“Higher Maintenance and Renovation Costs”

Purchasing a property in a bad location can result in higher ongoing maintenance and renovation costs. As the property struggles to attract tenants or buyers, owners may have to lower rental rates or renovate the property to increase its resale value. The additional costs can greatly impact your overall profit margins. It’s important to factor in these potential costs when making a decision on where to invest in real estate.

Overall, it’s essential to carefully consider all factors when investing in real estate. While a property may seem like a good investment at first glance, it’s important to take a closer look at its location and potential hidden costs. By doing so, you can make a more informed decision and avoid any costly surprises down the road.

“How to Identify the Right Location for Your Property Purchase”

“Researching the Local Real Estate Market”

It is essential to research the local real estate market thoroughly before making any property investment decisions. Look for trends and compare prices in similar areas. This will help you to identify which neighborhoods are more sought-after or appreciating faster than others, allowing you to make sound investment decisions.

“Assessing Your Personal Needs and Lifestyle Preferences”

Consider personal factors like work, commute time, daily routines, schools, and demographics in your neighborhood preferences. It is important to purchase property in a location that personally appeals to you.

“Consulting with Local Experts and Real Estate Agents”

Real Estate Agents have a wealth of knowledge and experience when it comes to property investment. They can guide you on the best locations suited to your needs, and also provide additional information on the local market.

“Visiting and Evaluating Potential Neighborhoods”

Visiting potential neighborhoods allows you to evaluate the community and everything it has to offer. Check the general cleanliness of the neighborhood, the accessibility of public transport, amenities, and general safety. It also allows you to get a firsthand look at the kind of people living within the neighborhood that can give you a better understanding of whether the particular neighborhood suits you or not.

Conclusion

Location, location, location; that’s the key to making a sound investment in property. Investing in the wrong location can lead to significant financial losses, lower rental income potential, and other hidden costs. On the other hand, purchasing property in a desirable location can lead to excellent returns on investment. By researching the local market, assessing your needs and identifying the signs of a bad location, you can avoid common purchasing mistakes and make sound investment decisions that can secure your financial future.